All Categories

Featured

There is no one-size-fits-all when it comes to life insurance policy./ wp-end-tag > In your active life, financial independence can appear like a difficult objective.

Fewer employers are supplying conventional pension plan plans and lots of business have lowered or discontinued their retired life strategies and your capacity to rely solely on social protection is in question. Even if benefits have not been reduced by the time you retire, social safety and security alone was never intended to be adequate to pay for the way of living you want and deserve.

/ wp-end-tag > As part of a sound financial approach, an indexed universal life insurance coverage policy can assist

you take on whatever the future brings. Before committing to indexed universal life insurance coverage, right here are some pros and disadvantages to consider. If you select an excellent indexed universal life insurance policy plan, you might see your money worth grow in worth.

Group Universal Life Insurance

If you can access it early, it may be valuable to factor it into your. Since indexed universal life insurance calls for a certain degree of risk, insurance policy firms tend to keep 6. This sort of plan also uses (iul marketing). It is still guaranteed, and you can change the face quantity and motorcyclists over time7.

Last but not least, if the chosen index doesn't carry out well, your cash money worth's growth will certainly be influenced. Usually, the insurance provider has a beneficial interest in carrying out much better than the index11. There is generally a guaranteed minimum interest price, so your plan's growth will not drop listed below a specific percentage12. These are all factors to be thought about when selecting the ideal kind of life insurance policy for you.

Universal Life Insurance Interest Rates

Because this kind of plan is much more intricate and has a financial investment part, it can typically come with greater costs than other policies like whole life or term life insurance policy. If you do not assume indexed global life insurance is best for you, right here are some choices to think about: Term life insurance is a short-term policy that usually supplies coverage for 10 to thirty years.

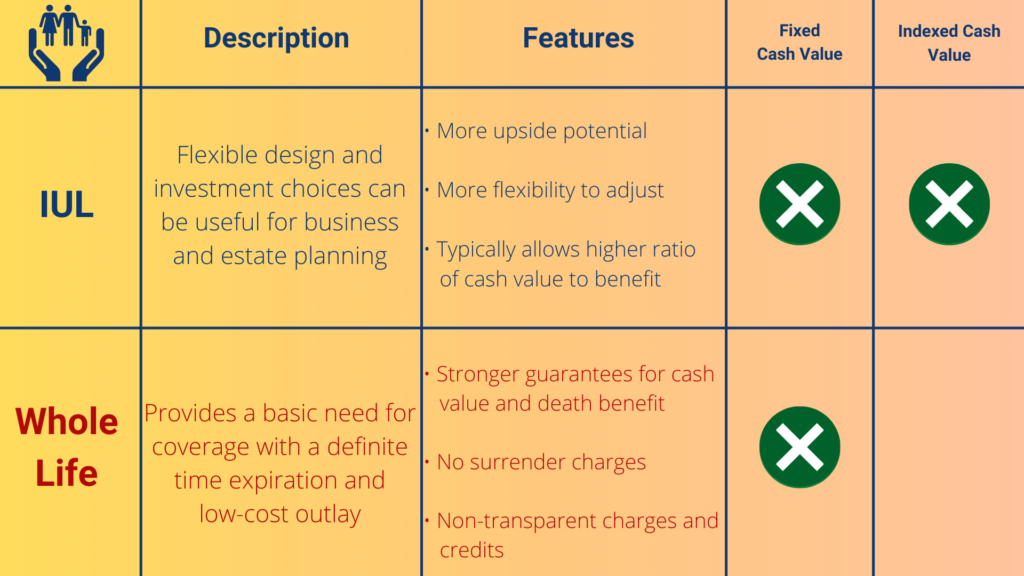

When deciding whether indexed global life insurance policy is ideal for you, it is very important to consider all your alternatives. Whole life insurance policy may be a much better selection if you are trying to find even more security and consistency. On the other hand, term life insurance may be a far better fit if you just need coverage for a specific time period. Indexed universal life insurance policy is a kind of policy that provides a lot more control and versatility, in addition to greater cash money value development potential. While we do not provide indexed universal life insurance policy, we can give you with more information about entire and term life insurance policy policies. We recommend discovering all your alternatives and talking with an Aflac agent to uncover the very best suitable for you and your family members.

The rest is included to the cash money worth of the plan after costs are deducted. The cash money value is credited on a month-to-month or annual basis with interest based on rises in an equity index. While IUL insurance policy may verify useful to some, it is essential to understand just how it works prior to buying a plan.

Latest Posts

What Is Group Universal Life

Indexed Universal Life Insurance Complaints

Compare Universal Life Insurance Rates