All Categories

Featured

State Ranch representatives sell every little thing from home owners to car, life, and various other popular insurance coverage products. State Ranch offers universal, survivorship, and joint universal life insurance coverage policies - universal whole life vs whole life.

State Ranch life insurance policy is typically conventional, using steady options for the typical American household. Nonetheless, if you're searching for the wealth-building chances of global life, State Farm does not have affordable alternatives. Read our State Farm Life insurance policy review. Nationwide Life Insurance Coverage markets all kinds of global life insurance policy: universal, variable universal, indexed global, and global survivorship plans.

Still, Nationwide life insurance policy strategies are extremely available to American households. It helps interested parties get their foot in the door with a reliable life insurance policy plan without the much more complex conversations about investments, monetary indices, etc.

Even if the worst takes place and you can't obtain a larger plan, having the protection of a Nationwide life insurance coverage plan might transform a buyer's end-of-life experience. Insurance policy business make use of clinical examinations to assess your danger class when applying for life insurance.

Purchasers have the alternative to alter prices monthly based upon life scenarios. Of course, MassMutual offers interesting and potentially fast-growing opportunities. These strategies often tend to perform ideal in the lengthy run when early down payments are higher. A MassMutual life insurance policy representative or financial expert can assist purchasers make strategies with room for adjustments to meet temporary and long-lasting financial objectives.

Max Funded Life Insurance

Review our MassMutual life insurance coverage review. USAA Life Insurance is recognized for providing budget-friendly and extensive monetary products to armed forces members. Some purchasers might be amazed that it supplies its life insurance policy plans to the public. Still, armed forces members appreciate one-of-a-kind advantages. Your USAA plan comes with a Life Occasion Option cyclist.

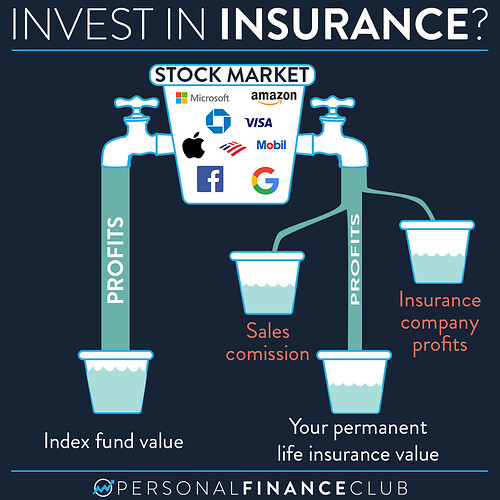

VULs include the highest risk and the most prospective gains. If your plan does not have a no-lapse guarantee, you might also shed insurance coverage if your money worth dips below a certain threshold. With so much riding on your financial investments, VULs need constant focus and maintenance. As such, it might not be a great option for individuals that merely desire a fatality benefit.

There's a handful of metrics whereby you can judge an insurer. The J.D. Power client contentment ranking is a good alternative if you desire a concept of just how clients like their insurance coverage plan. AM Ideal's economic stamina score is one more vital statistics to consider when selecting an universal life insurance policy firm.

This is specifically essential, as your money worth expands based upon the financial investment alternatives that an insurance provider offers. You must see what financial investment options your insurance policy provider offers and compare it versus the objectives you have for your plan. The most effective way to discover life insurance is to collect quotes from as several life insurance policy companies as you can to recognize what you'll pay with each policy.

Latest Posts

What Is Group Universal Life

Indexed Universal Life Insurance Complaints

Compare Universal Life Insurance Rates