All Categories

Featured

Table of Contents

This plan style is for the customer that requires life insurance policy but want to have the capability to select exactly how their cash money value is spent. Variable plans are financed by National Life and distributed by Equity Providers, Inc., Registered Broker/Dealer Affiliate of National Life Insurance Policy Company, One National Life Drive, Montpelier, Vermont 05604.

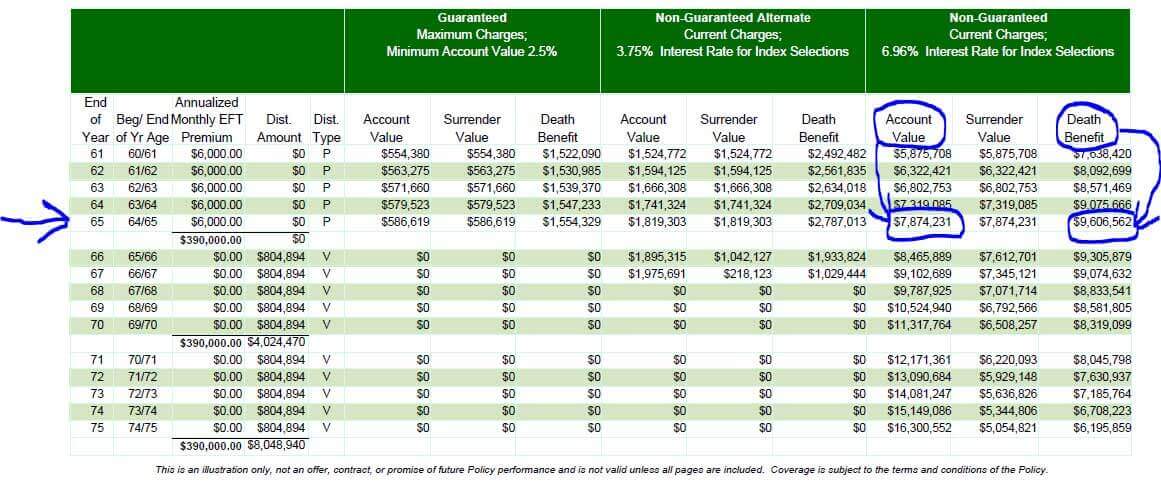

A entire life insurance policy plan covers you for life. It has cash money worth that grows at a fixed rate of interest and is the most typical sort of permanent life insurance policy. Indexed global life insurance is additionally long-term, yet it's a specific kind of global life insurance policy with cash worth connected to a securities market index's efficiency as opposed to non-equity gained prices. The insurance provider will certainly pay out the face amount directly to you and end your policy. Contrastingly, with IUL policies, your survivor benefit can raise as your cash money value grows, bring about a possibly greater payment for your beneficiaries.

Discover the many advantages of indexed universal insurance policy and if this sort of policy is best for you in this interesting post from Safety. Today, many individuals are considering the worth of long-term life insurance policy with its ability to offer long-term protection together with cash money value. indexed global life (IUL) has come to be a popular selection in supplying irreversible life insurance policy protection, and an even better capacity for development through indexing of rate of interest debts.

Why should I have Iul Cash Value?

However, what makes IUL different is the method passion is credited to your plan. Along with using a typical proclaimed rate of interest, IUL supplies the opportunity to make rate of interest, based on caps and floors, that is connected to the efficiency of a chosen choice of market indices such as the S&P 500, Dow Jones Industrial Average or the Nasdaq-100.

With IUL, the insurance policy holder selects the quantity designated amongst the indexed account and the dealt with account. Just like a regular universal life insurance policy plan (UL), IUL enables for a versatile premium. This implies you can choose to add even more to your plan (within government tax obligation regulation restrictions) in order to help you construct up your cash money worth even much faster.

As insurance policy plans with investment-like attributes, IUL policies bill payments and charges. These costs can reduce the cash money worth of the account. While IUL policies likewise use ensured minimal returns (which might be 0%), they additionally cap returns, even if your choose index overperforms (Indexed Universal Life premium options). This suggests that there is a limit to price of money worth growth.

Composed by Clifford PendellThe advantages and disadvantages of indexed universal life insurance coverage (IUL) can be challenging to make sense of, specifically if you are not knowledgeable about just how life insurance policy functions. While IUL is just one of the most popular products on the market, it's likewise among the most unstable. This kind of coverage might be a viable option for some, but also for a lot of individuals, there are better alternatives avaiable.

Who has the best customer service for Iul For Retirement Income?

If you have a negative return, you will not have an unfavorable attributing price. Rather, the price will usually be 0 or 1 percent. Furthermore, Investopedia checklists tax benefits in their advantages of IUL, as the survivor benefit (cash paid to your beneficiaries after you pass away) is tax-free. This holds true, yet we will certainly add that it is also the case in any kind of life insurance coverage plan, not simply IUL.

The one thing you need to know concerning indexed global life insurance coverage is that there is a market threat included. Investing with life insurance policy is a various game than acquiring life insurance policy to protect your family members, and one that's not for the pale of heart.

All UL items and any type of basic account item that depends on the performance of insurers' bond profiles will certainly be subject to passion rate threat."They proceed:"There are intrinsic risks with leading customers to think they'll have high prices of return on this product. A customer may slack off on funding the money worth, and if the policy does not perform as expected, this can lead to a lapse in protection.

In 2014, the State of New York's insurance coverage regulatory authority penetrated 134 insurers on exactly how they market such policies out of problem that they were overemphasizing the potential gains to customers. After continued scrutiny, IUL was struck in 2015 with policies that the Wall Street Journal called, "A Dose of Fact for a Hot-Selling Insurance Item." And in 2020, Forbes released and write-up labelled, "Appearing the Alarm on Indexed Universal Life Insurance Policy."Despite numerous write-ups cautioning customers about these plans, IULs remain to be among the top-selling froms of life insurance policy in the USA.

What are the top Indexed Universal Life Insurance providers in my area?

Can you take care of seeing the supply index execute inadequately understanding that it directly impacts your life insurance policy and your capability to shield your household? This is the final intestine check that hinders even extremely affluent investors from IUL. The entire point of buying life insurance policy is to lower danger, not develop it.

Discover more regarding term life right here. If you are searching for a policy to last your entire life, have a look at assured global life insurance policy (GUL). A GUL plan is not practically long-term life insurance, but instead a hybrid in between term life and universal life that can enable you to leave a legacy behind, tax-free.

Your expense of insurance policy will not alter, even as you get older or if your wellness modifications. Your insurance coverage isn't tied to an investment. You pay for the life insurance policy security just, much like term life insurance policy (IUL accumulation). You aren't putting money right into your plan. Trust the economic experts on this: you're far better off placing your money right into a savings or possibly paying for your home loan.

How much does Iul Protection Plan cost?

Guaranteed global life insurance is a portion of the expense of non-guaranteed universal life. You do not risk of shedding insurance coverage from undesirable investments or adjustments out there. For an extensive comparison in between non-guaranteed and ensured universal life insurance coverage, click here. JRC Insurance Team is here to aid you find the appropriate plan for your demands, without any added price or cost for our aid.

We can recover quotes from over 63 top-rated carriers, permitting you to look past the big-box firms that often overcharge. Get begun currently and call us toll-free at No sales pitches. No stress. No commitments. Consider us a close friend in the insurance policy industry who will certainly look out for your best interests.

How do I compare Guaranteed Interest Indexed Universal Life plans?

He has helped thousands of family members of services with their life insurance requires since 2012 and specializes with applicants that are much less than best wellness. In his extra time he takes pleasure in hanging out with family members, taking a trip, and the open airs.

Indexed global life insurance policy can help cover many economic requirements. It is just one of lots of kinds of life insurance coverage offered. As you go via your insurance policy choices, you might be unsure of what could be best for your requirements and scenario. Indexed universal life insurance policy is a kind of universal life insurance coverage.

Latest Posts

What Is Group Universal Life

Indexed Universal Life Insurance Complaints

Compare Universal Life Insurance Rates